Marvell’s Bold Move into AI and Data Centers: A Smart Investment or Overvalued Bet?

In this article, we’ll dive into Marvell’s business, their shift toward data centers, and provide a brief stock analysis.

Hey everyone, welcome back to TheTechBruin for this week’s technology deep-dive focused on Marvell and our opinions on the business.

DISCLAIMER: None of this is investment advice and we are by no means experts. We are simply college students writing to further our technology industry knowledge.

Table of Contents

- Marvell Overview

- Market Segments and Product Segments

- Trends and Financials

- Valuation and Stock Outlook

Marvell Overview

Fabless chip designers have become a dominant force in the semiconductor industry over the past two decades. Companies like Nvidia, AMD, and Apple have adopted this business model and found substantial success. Marvell Technology, while less well-known, plays a significant role in this space, specializing in designing and developing chips for data centers, enterprise networking, and automotive/industrial markets.

Founded in 1995 and headquartered in Santa Clara, California, Marvell gained early momentum during the internet infrastructure boom of the late 1990s and early 2000s. Today, Marvell is publicly traded on NASDAQ (MRVL), with a share price hovering around $70 and a market cap of approximately $65 billion.

Marvell’s product portfolio is extensive, covering system-on-chip (SoC) designs, networking infrastructure components, and storage controllers. The company has positioned itself as a leader in providing semiconductor solutions for data centers, which has become a critical growth area, especially in the context of the rise of artificial intelligence (AI) and cloud computing.

Market Segments and Product Segments

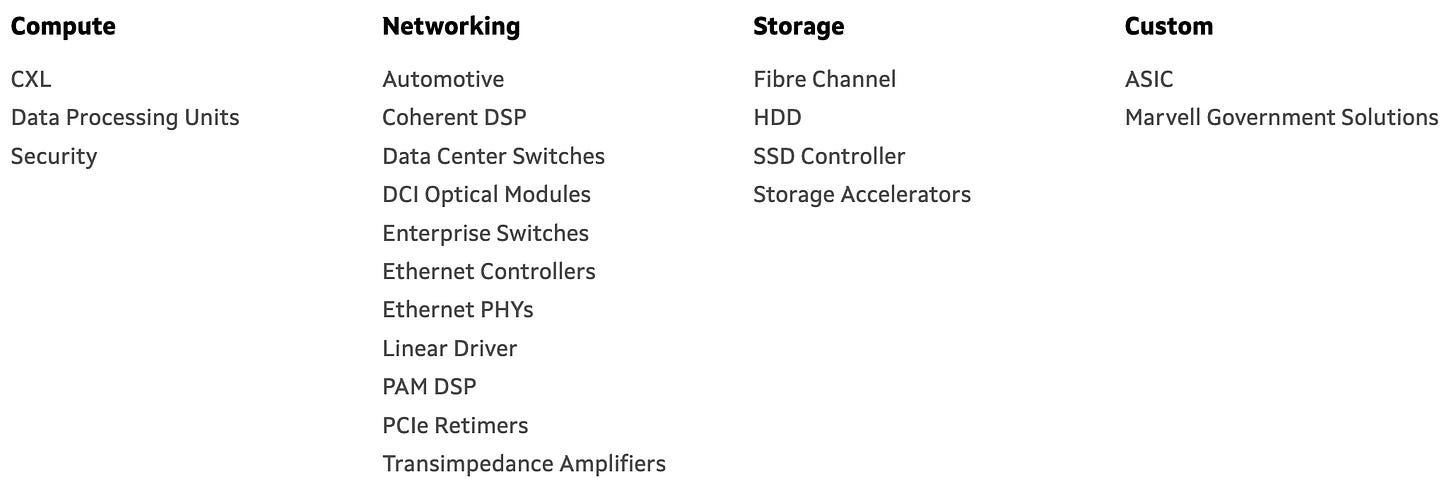

Marvell’s business is divided into five key market segments:

1. Data Center (65-70% of revenue)

2. Enterprise Networking (11-12% of revenue)

3. Carrier Infrastructure (6-7% of revenue)

4. Consumer (6-7% of revenue)

5. Automotive/Industrial (6-8% of revenue)

Marvell’s success in these markets is underpinned by a broad product line that includes:

- Data Processing Units (DPUs): Marvell’s DPUs are a critical component for cloud computing, enabling efficient data management and storage in data centers.

- Networking Infrastructure: Products such as switches, routers, and PHYs (Physical Layer devices) are crucial for high-speed networking solutions in enterprises and data centers.

- Electro-optics: Marvell designs digital signal processors, laser drivers, and other high-speed data center connectivity solutions.

- Application-Specific Integrated Circuits (ASICs): Custom chips designed for specific client applications, allowing for optimization in areas like cloud and AI workloads.

- Storage Controllers: Historically, Marvell was a leader in storage controllers for HDDs and SSDs, though the focus has shifted to higher-growth areas.

Although the company still manufactures storage controllers, the bulk of Marvell’s current revenue comes from its ARM-based SoCs, DPUs, and fiber-optic products, thanks to growing demand in the data center space.

Marvell’s deep integration into the data center sector also means they are in direct competition with other large fabless semiconductor firms and integrated device manufacturers (IDMs). These include Intel, NVIDIA, AMD, and Microsoft (following its acquisition of Fungible), as well as companies in the broader networking and automotive markets.

A critical point of consideration for Marvell’s business is its heavy reliance on China, which accounts for about 46% of its revenue. Given the geopolitical tensions surrounding the U.S.-China relationship in the semiconductor industry, this could pose risks for the company’s supply chain and market access in the future.

Trends and Financials

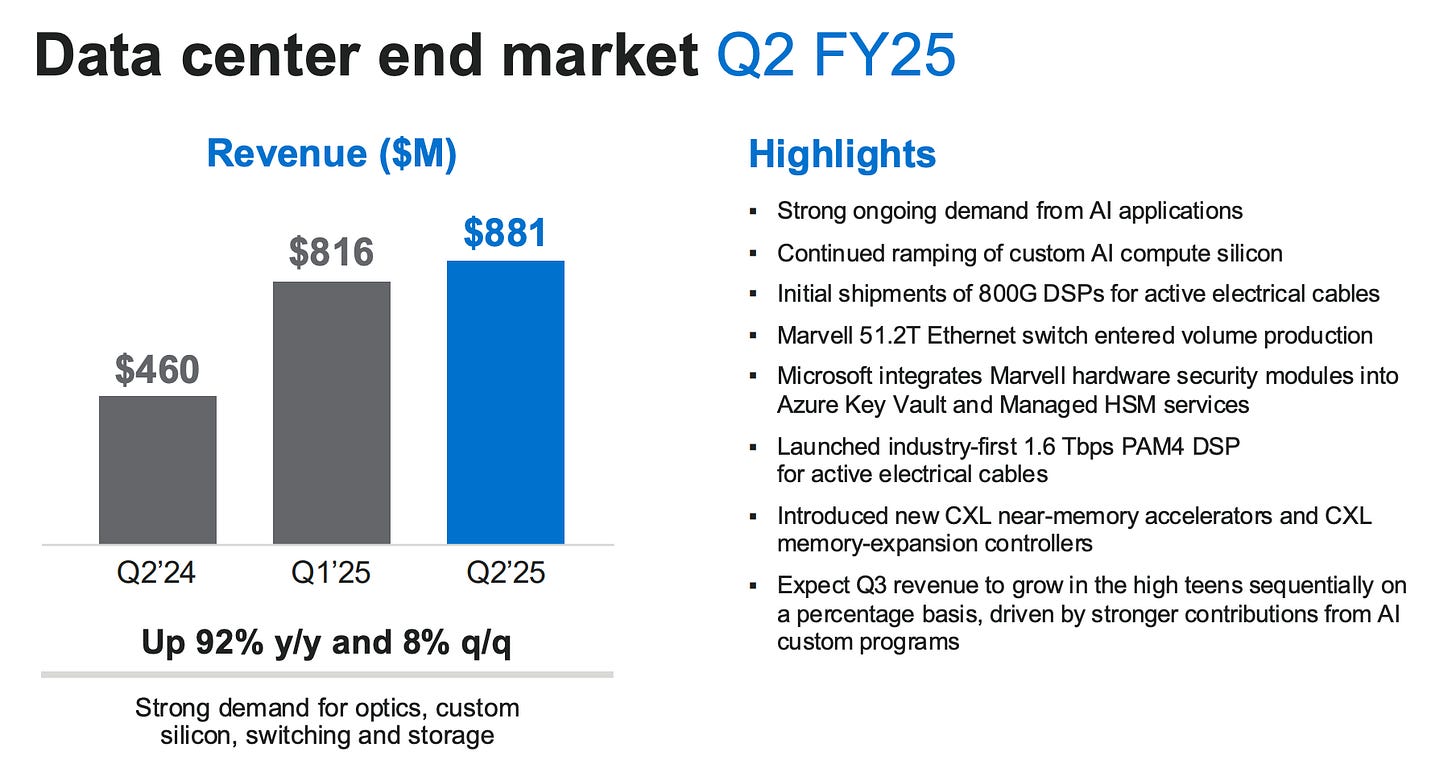

Over the years, Marvell has strategically shifted from being a dominant player in the disk drive and networking equipment industries to focusing heavily on data centers. Their pivot to an AI-centric strategy, which targets the expanding role of data centers in cloud computing and AI, is evident. The data center now accounts for 65-70% of the company’s total revenue, a substantial leap from 40% just a few years ago. This transition has seen Marvell reduce its exposure to markets like enterprise networking, carrier infrastructure, and automotive/industrial sectors, effectively halving their contribution to revenue.

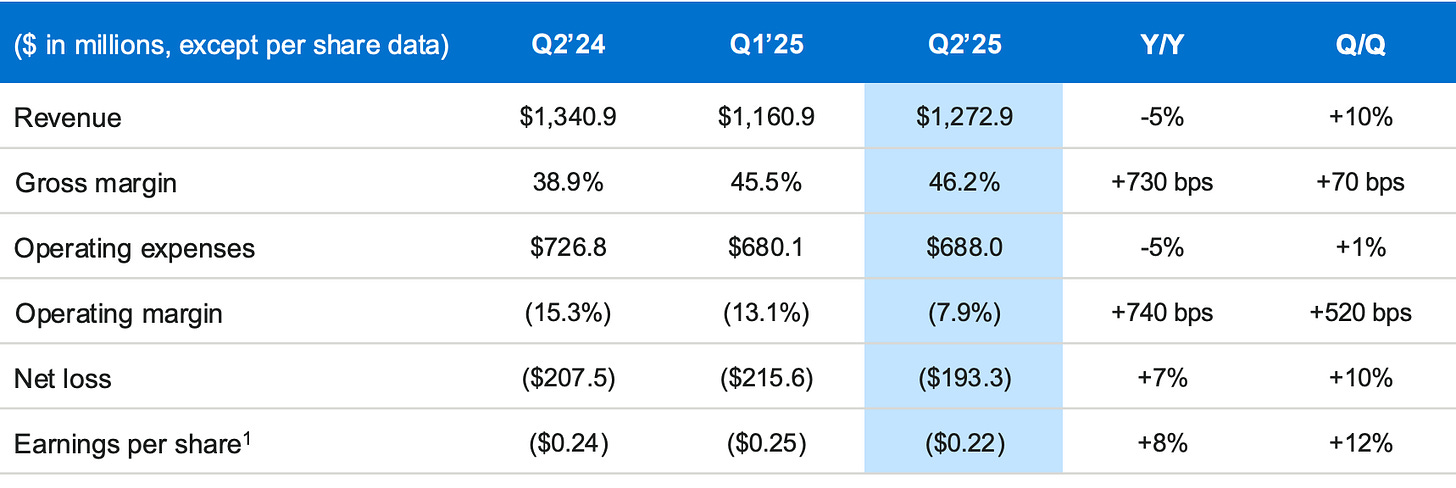

The company’s Q2 financials highlight this shift, with gross margins improving to 46% (up from 38.9% in Q2 2023) and revenue hitting $1.272 billion. However, the company’s guidance suggests that revenue growth will be slower in the short term, with single-digit growth expected for Q3.

This drop in revenue from non-data center markets reflects broader industry trends, such as weakening demand in enterprise networking, carrier infrastructure, and automotive/industrial sectors. Additionally, Marvell’s reliance on a few key customers has contributed to the cyclicality of its revenue streams. However, their transition toward AI and data centers has set them up for long-term growth.

Marvell has seen strong revenue growth over the last three years, largely driven by its focus on data centers and AI. While revenue growth plateaued in 2023, the company’s forecast suggests a rebound, with expectations for stronger growth by the end of 2025 as the data center market continues to expand.

Case Study: NetApp

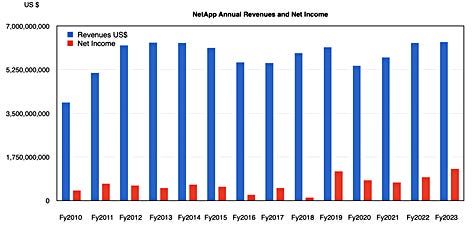

Many similar companies have made shifts in the data center space over the past few years. One example of this shift in focus is NetApp (NYSE: NTAP) which provides full-service data infrastructure solutions allowing companies to create and manage tailored large-scale data storage solutions with offerings across storage hardware, storage management software, and integration services.

The company has experienced stagnating revenue growth since 2019, with revenue for FY2024 at $5.6B down 14% since 2019, largely due to slow competitive reactions to rapidly changing storage demands from data center and cloud computing providers. Although the company has recently shifted to providing faster and more affordable flash storage offerings through the launch of its AFF C-Series array, revenue has yet to see a noticeable bump in revenue potentially due to the long sales cycles in the space.

It is interesting to note though that the company has successfully catered to data center and cloud customers, recovered revenue from 2018 lows, and most importantly increased Net Income margins for 3 years continuously. This has occurred while hardware sales have remained generally flat, potentially signaling that the commonly discussed positive headwinds in the data center space can manifest in gross margin wins. When considering Marvell and the questions surrounding its margins, it is important to note that similar-scale companies like NetApp have successfully raised margins under tumultuous macro conditions and done so without sacrificing hardware sales, potentially validating the gross margin upside seen in the future for Marvell. We will talk about this a bit more in the Stock outlook but we believe that this case represents precedent within the 180 of a business into the data center.

Marvell’s Stock Outlook

Marvell’s stock performance has been noteworthy since the onset of the COVID-19 pandemic. The company’s revenue has surged by 80-90% compared to pre-pandemic levels, driven primarily by its pivot to data centers and AI-driven infrastructure.

As Marvell continues to focus on this growing market, the question remains whether this shift will lead to improved margins. Historically, Marvell achieved higher margins in 2018, before its data center transition. The challenge in predicting margin growth in a rapidly evolving market like AI and data centers adds complexity to the company’s valuation.

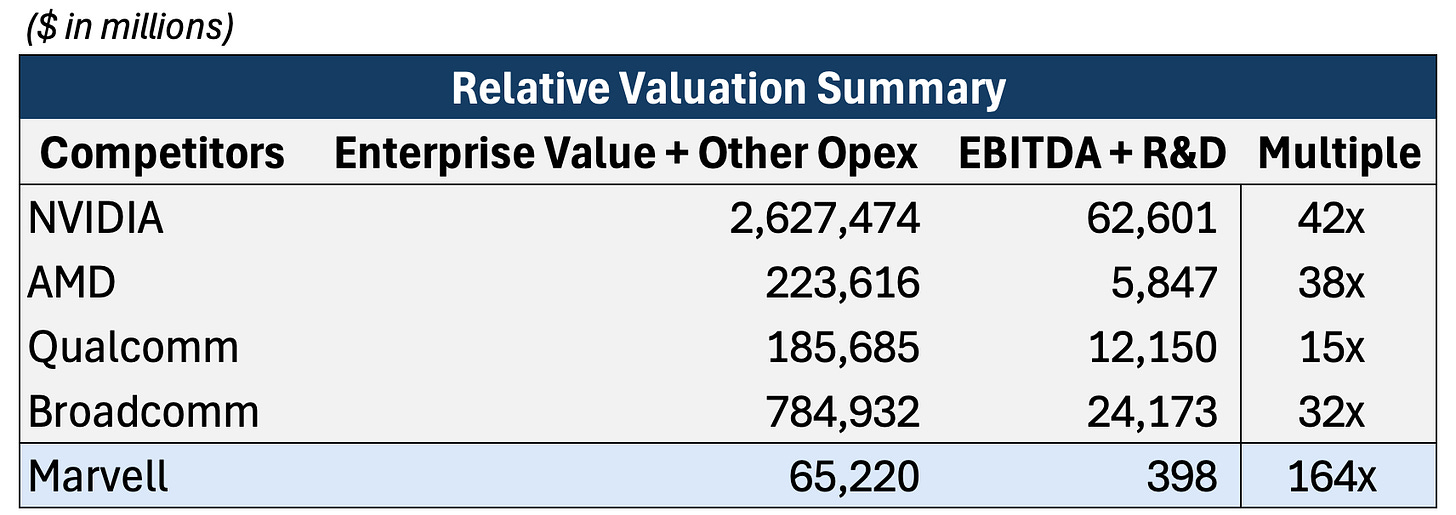

To assess Marvell’s valuation, we utilized a gross margin-based multiple approach due to its negative operating margin. Given the importance of R&D in the fabless semiconductor industry, we adjusted gross margins to include R&D expenses when calculating the enterprise value (EV).

In comparing Marvell to its peers—NVIDIA, Qualcomm, Broadcom, and AMD—Marvell’s valuation appears high, with a multiple of 164x, compared to 42x for NVIDIA, 15x for Qualcomm, 32x for Broadcom, and 38x for AMD. Lower-valued companies generally have less exposure to the AI-driven data center market, which is one factor driving Marvell’s higher multiple.

One key factor driving valuation multiples in the semiconductor industry is the volume of unit shipments in the data center market. While Marvell ships a significant volume of products, they are not necessarily high-margin items like those from NVIDIA. Additionally, outside of the data center, Marvell's product mix doesn’t include as many high-margin items as any of the companies.

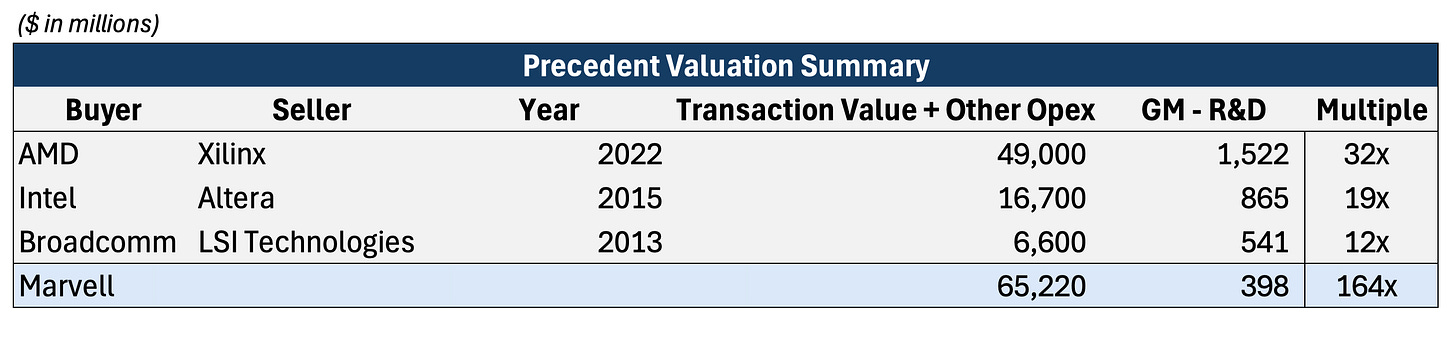

However, it is pretty unfair only to compare other fabless designers as the US-based companies are all a lot bigger than Marvell, and competitors with similar valuations are mostly based in Taiwan. But, all of their US-based peers have been sold over the last decade and a half.

Based on this we can still see that multiples in the fabless design market have risen over the years but even in 2022 the exit multiple for Xilinx was 32x, still a lot higher than Marvell’s current trading multiple.

Despite its high valuation, I wouldn’t classify Marvell as a “sell” at this point. The company’s overvaluation compared to peers may be justified as the data center market matures, and its margins could improve in the long run. They have only been in the market heavily for a couple of years and are still reorganizing corporate efforts at a large scale.

At present, Marvell’s sell case is under the assumption that we don’t see a significant margin turnaround over the next 3-5 years. If they can pull this shift to the data center off and increase margins, then I think that this stock is a clear buy based on the hype around the data center and the successful repositioning of their business within the space.

SIDE NOTE: We need to watch the relationship between the US and China. Political concerns or restrictions of any kind may directly affect Marvell’s business in China and therefore reduce revenue by a significant amount due to their concentration in sales to China. This could be something that we consider a risk to the business, but it is very unclear as to how this political relationship will affect Marvell.

Thank you for reading and hopefully this helps you guys gain some insight into Marvell. Please feel free to reach out to us with any differing opinions or ways we may be able to improve our investing rationale.

Email: thetechbruin@gmail.com

Twitter/X: @TheTechBruin