Procore: Deep Dive and Investment Thesis

In this article we will be deep diving Procore's business and giving our commentary on their position within the market

Hey everyone, welcome back to TheTechBruin for this week’s technology deep-dive focused on Procre and our opinions on the business/stock.

DISCLAIMER: None of this is investment advice and we are by no means experts. We are simply college students writing to further our technology industry knowledge.

The Origins of the Construction Software Giant

Tooey Courtemanche’s journey to founding Procore began in his teenage years working in the construction industry. He quickly noticed inefficiencies in the process but chalked it up to a lack of technology. After spending 20 years in real estate development, Courtemanche returned to construction and was shocked to find that, despite the passage of time, nothing had changed. Frustrated by the bureaucratic nature of construction operations, he was inspired to create a more efficient operating system for contractors and project owners. This led to the founding of Procore in 2002.

Based in Carpinteria, CA, Procore has expanded globally with offices in Egypt, Australia, Great Britain, and other countries. Since its 2019 IPO, the company has grown rapidly, becoming the leader in construction management software. With its construction-focused go-to-market (GTM) strategy, Procore continues to dominate this relatively immature vertical market, outpacing competitors like Oracle, Trimble, and Autodesk. As of now, Procore boasts a market cap of $8.02 billion and trades at around $54 per share.

A Quick Industry Primer

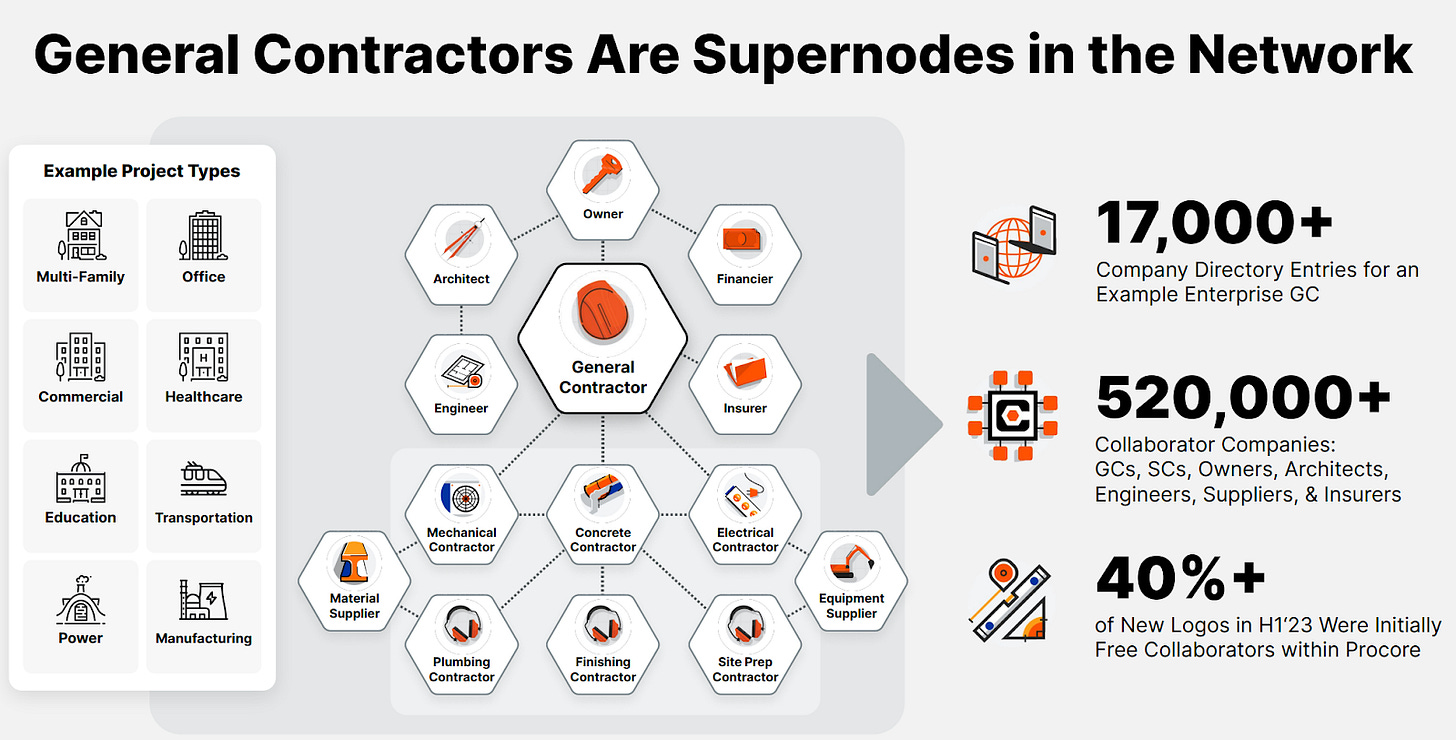

Within any given project, it will be initiated by an owner, designed by engineers or architects, and built by a contracting company (usually multiple).

Construction projects involve several key phases:

1. Budgeting – Project owners initially project a budget, which helps in resource planning, though it is subject to changes.

2. Design – Architects and engineers develop the designs.

3. Bidding – Contractors bid for the project.

4. Planning – Owners identify the specialty contractors needed for the project.

5. Construction – The project itself is built.

6. Payment & Invoicing – Contractors, designers, and all involved parties are compensated.

While there are many more steps in a construction project, these are the main phases to understand how Procore assists at each stage.

Another key thing to understand is that construction workflows often differ by region. This results in each specific region/country having different tools, and workflows for their projects.

What Does Procore Do?

So, what exactly does Procore offer? In short, Procore streamlines construction management and removes the silos that often exist between owners (those who fund and initiate projects), contractors (those who build the projects), and design professionals like architects and engineers. Additionally, Procore bridges the gap between on-site and office-based teams, offering software that works seamlessly on field service devices and in the office. This ensures that everyone is on the same page, leading to fewer delays, more accurate budgeting, better labor scheduling, and overall cost savings.

What makes Procore stand out is its global approach. Unlike other construction management software that focuses on a specific region or company, Procore caters to a worldwide audience. This global strategy significantly increases its total addressable market (TAM), setting it apart from its competitors.

Business Overview

Procore’s customer base includes:

- Owners: Owners are the people who make the projects and fund them. Procore provides owners with visibility into all aspects of the construction process. It allows them to collaborate with contractors and designers for free (though with limited access), which helps streamline operations and reduce costs.

- Contractors: Contractors are the people who build the projects. Procore simplifies the bidding process and offers full lifecycle project management. Contractors can communicate easily with on-site teams and use labor analytics to improve efficiency for future bids.

- Designers: Architects and engineers benefit from Procore’s Building Information Modeling (BIM) tools, allowing for faster turnaround times and smoother collaboration with owners and contractors.

Procore operates on a subscription-based business model, charging companies a fixed fee based on their annual construction volume (ACV). Their pricing options vary based on contract length and volume.

Procore’s product lineup includes five major categories:

Pre-Construction – Budgeting, bidding, and initial planning.

Project Execution – Project management, safety and quality, and BIM tools.

Workforce Management – Field productivity and workforce planning.

Financial Management – Budgeting, invoicing, accounting integrations, lien rights (via the acquisition of LevelSet), and Procore Pay for payments.

Construction Intelligence – Analytics tools that help companies store and analyze project data.

Although third-party integrations are available for many functions, Procore makes it easy to use these on their platform, allowing for seamless upgrades to Procore’s own tools.

Investment Thesis

After explaining what Procore does, let’s dive into why I’m bullish on the stock.

Total Addressable Market (TAM)

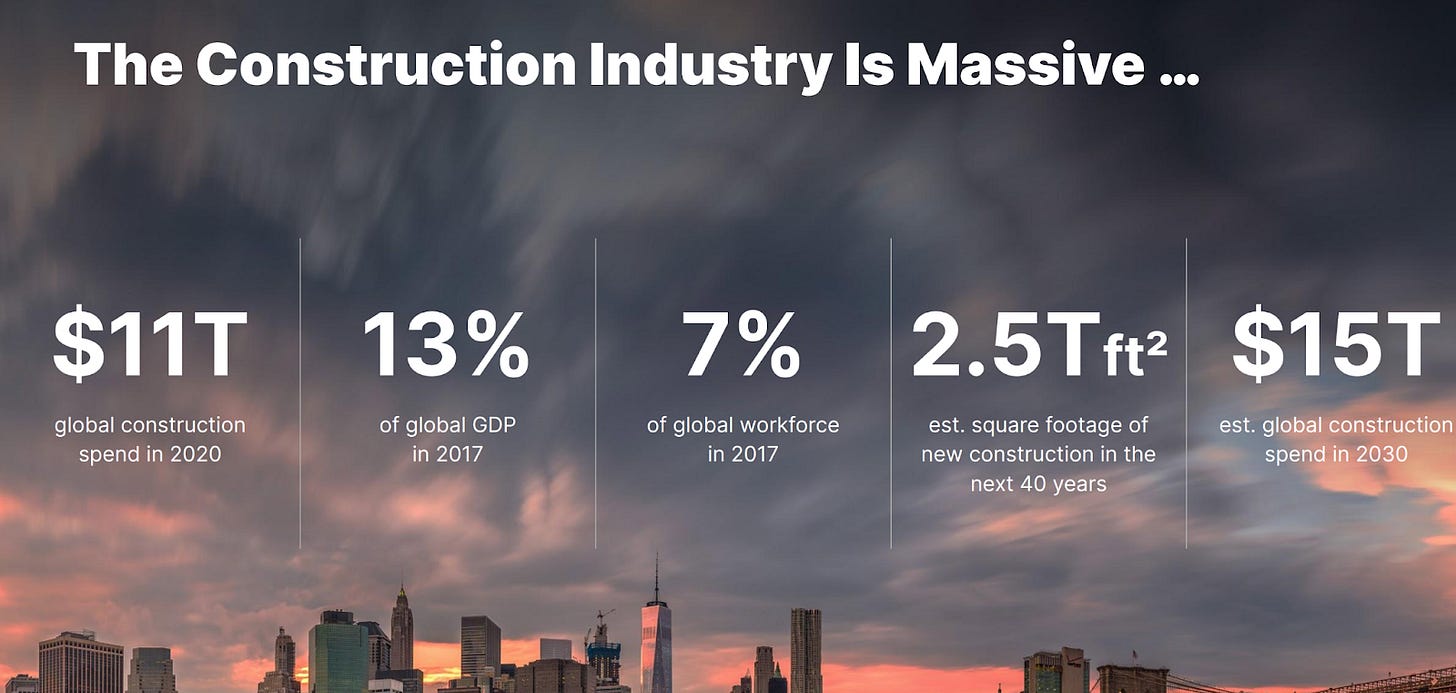

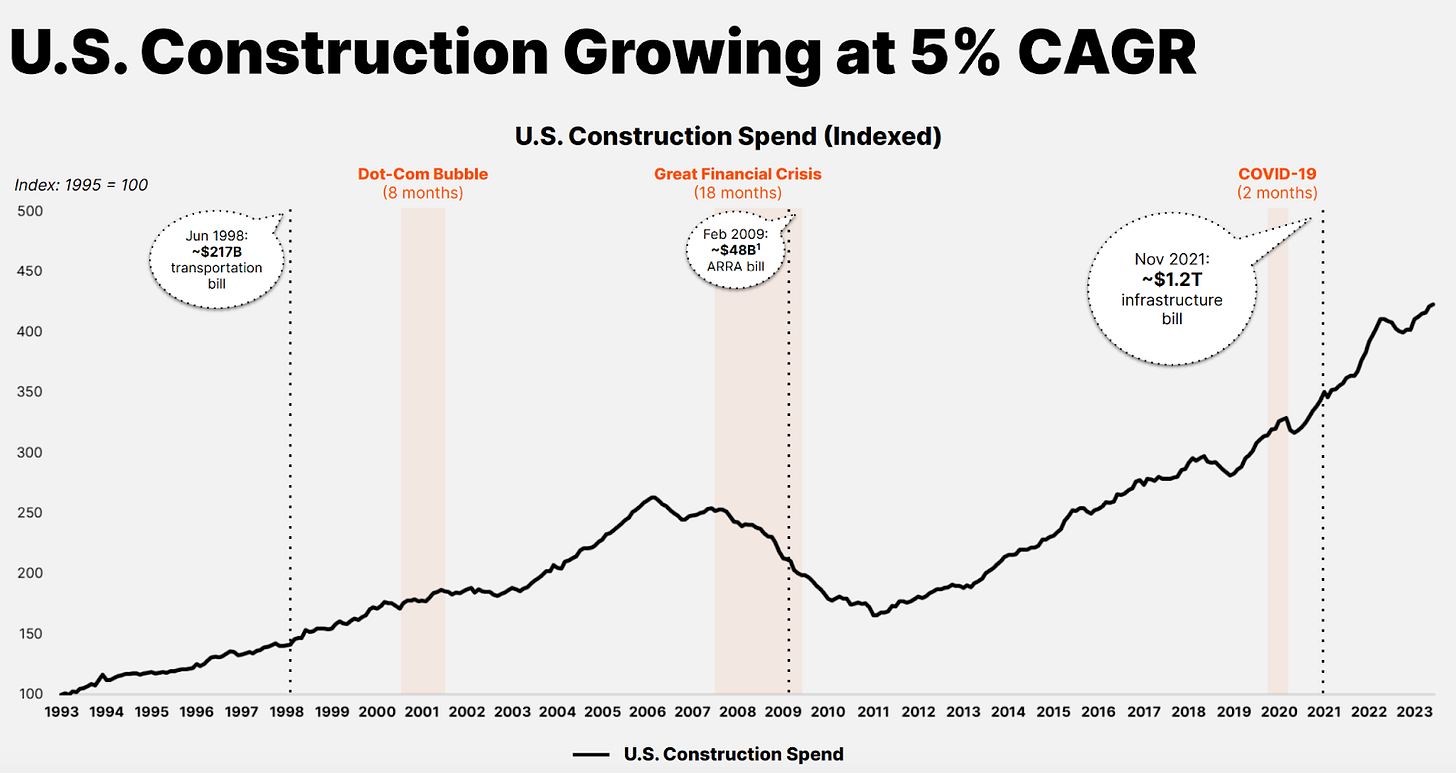

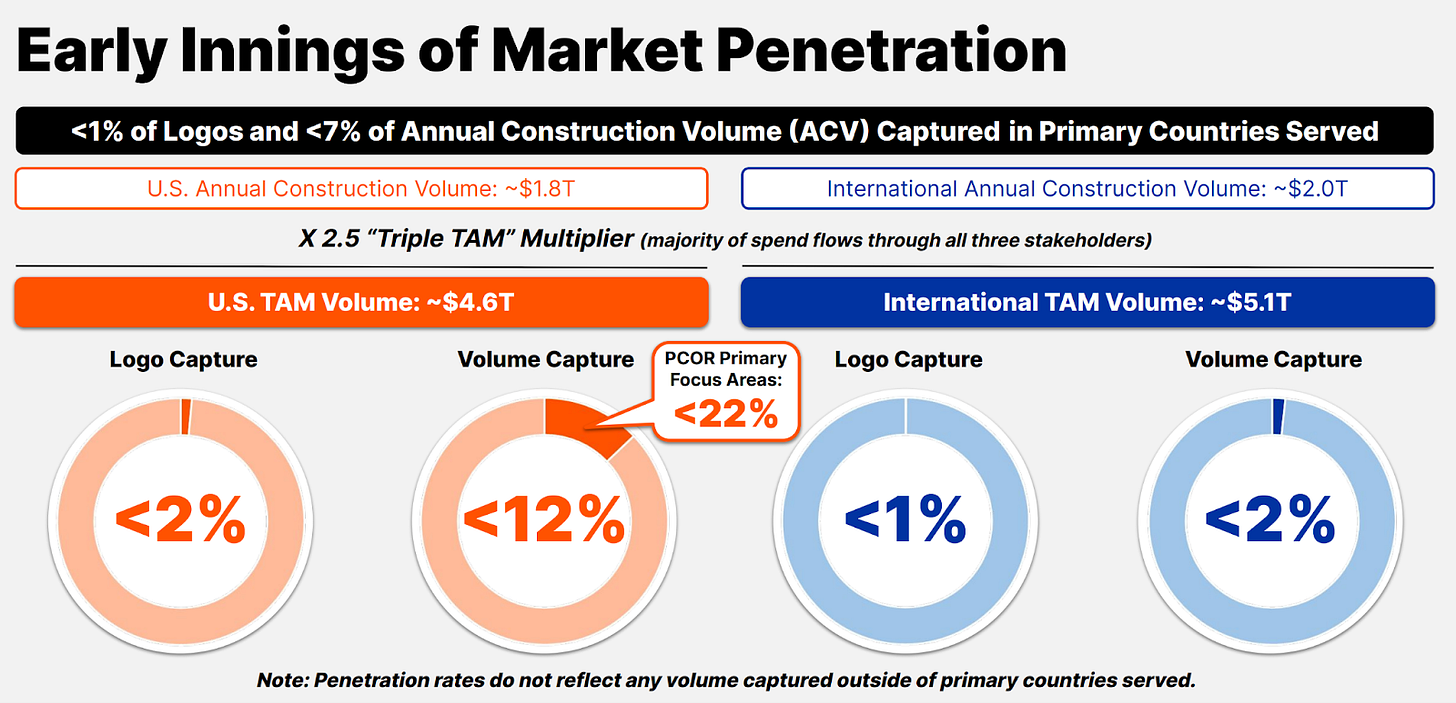

Procore has only scratched the surface of its potential market, both domestically and globally. As highlighted in their 2023 Investor Presentation, the construction industry handles nearly $2 trillion in annual volume.

The slow adoption of technology and the bureaucratic nature of the industry leave a vast opportunity untapped. And as technology takes its natural course through the industry as it already has during the pandemic, more companies will be inclined to hop on the Procore platform.

Procore’s Vertical GTM Strategy & Best-in-Class Software

Procore’s vertical GTM strategy—focusing specifically on construction—has allowed it to build deep relationships in the industry. They host numerous construction conferences, blog about industry workflows, and even track input prices in real time on their website. This starkly contrasts competitors like Oracle, Trimble, and Autodesk, whose horizontal-to-vertical approach dilutes their focus. Procore’s dedicated vertical strategy ensures that its products remain tailored to the specific needs of construction professionals. This also boosts the conversion rate of contractors/designers using the platform as a free partner.

You might wonder why more niche startups don’t threaten Procore’s dominance. The construction industry is highly reputation-focused, and Procore’s established track record gives it a significant advantage over newer competitors. Their end-to-end offering also locks in customers, making it difficult to switch to another software once all operations are integrated into Procore’s platform.

Financials

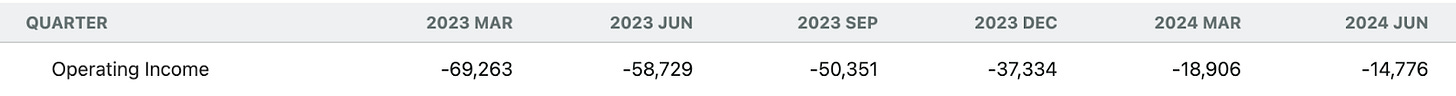

Procore’s financials are solid, with consistent year-over-year and quarter-over-quarter growth. Their logo retention rate hovers around 95%, while dollar retention is between 114% and 117%. With gross margins of about 83%, Procore is also cash-flow positive, and free cash flow (FCF) margins are expected to increase. On top of this their Operating Margin, although negative, has been drastically improving YoY.

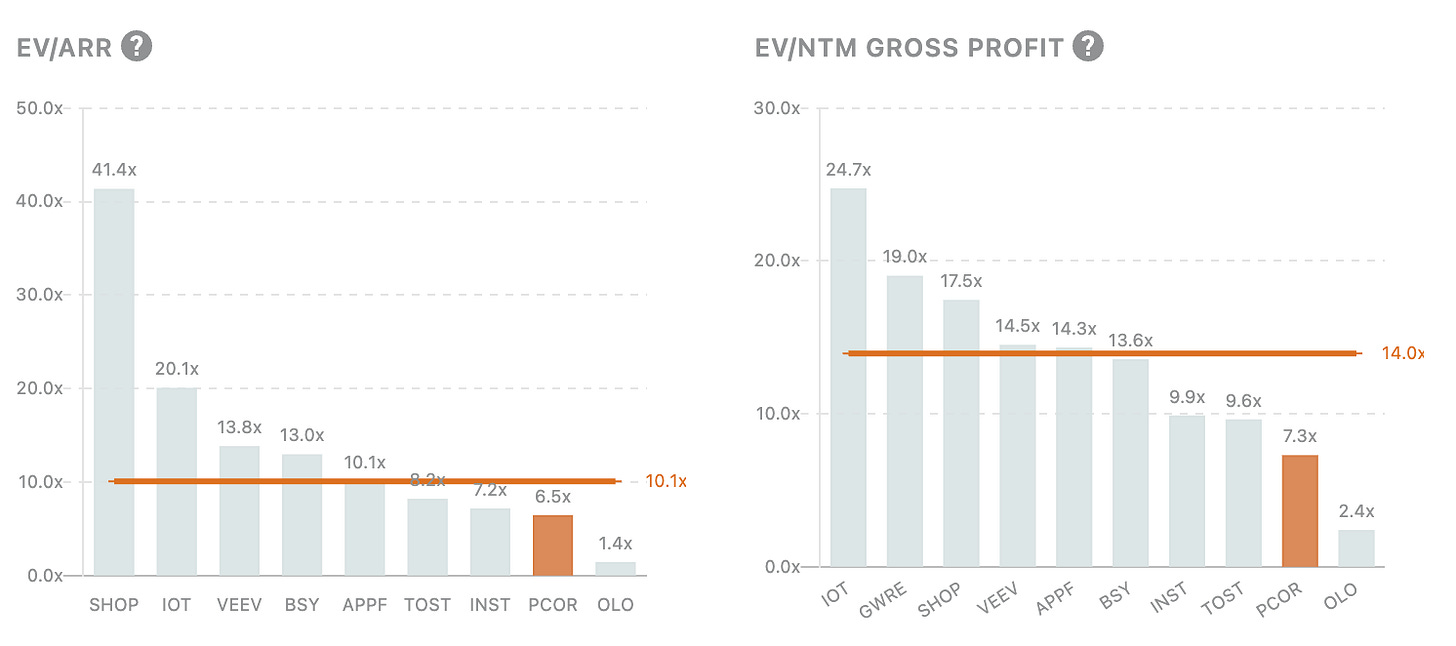

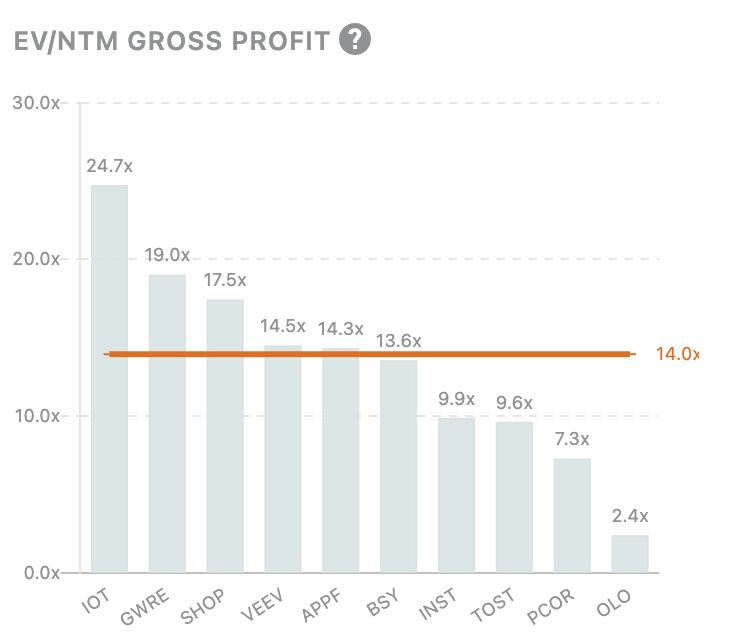

According to data from Public Comps and Clouded Judgment by Jamin Ball, Procore is undervalued relative to other vertical SaaS companies, trading below the median for EV/NTM Revenue/NTM Growth, and other valuation multiples.

When compared to other high growth (20%+ ARR Growth) vertical SaaS businesses, we can see that they still fall pretty low in valuation on an ARR and GP basis.

This low valuation doesn’t make too much sense when looking at their strong growth, improving margins, and retention figures.

Why Is Procore Undervalued? The Management Shift

A recent drop in Procore’s stock price was attributed to investor concerns over the company’s management structure shift. Procore has moved from a matrix management model to a general manager (GM) model, which focuses on regional teams and faster product sprints. While some investors fear this change may increase risk, I believe it will benefit Procore in the long run for a couple of reasons

The construction industry is fragmented by region.

The development teams need to adapt the product to regional concerns.

The GM model allows for a regional team to hyper-focus on their regional customers.

This will lead to higher retention and stickiness among customers as well as a larger amount of regional growth due to a faster and more streamlined sales cycle.

The GM model will likely accelerate product development and the sales cycle by allowing Procore to focus on each region's specific needs. The fragmented nature of the construction industry makes this shift logical.

Typically, companies move away from the GM model as they mature, so this transition signals that Procore still views itself as early-stage. Having captured only a small portion of a multitrillion-dollar market, their focus on regional customer expansion positions them to unlock significant growth potential.

Price Target

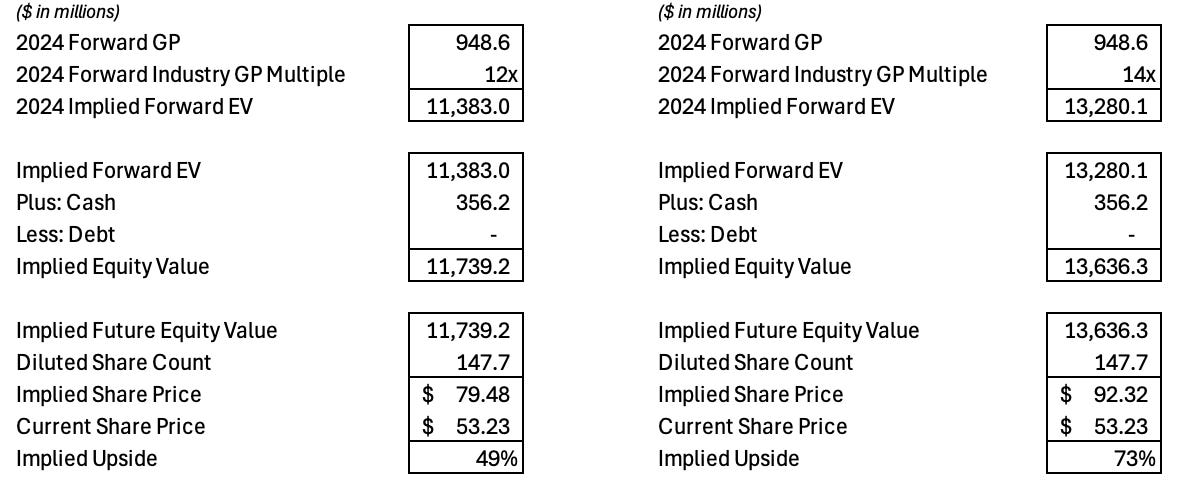

For the price target of Procore, I wanted to do a very rudimentary valuation based on a GP multiple. I took a baseline multiple from a lot of high-growth vertical software companies.

Using this 14.0x multiple I set my base case to 13.0x and bull case to 15.0x. This is how the valuation build looks like below, keep in mind this was done very rudimentarily and there are a lot of adjustments that should be made but in the context of this article, this should give us a very generalized case of how I think Procore should be valued.

Final Thoughts

In summary:

Procore’s TAM is vast and largely untapped.

Their vertical GTM strategy and industry-leading software position them to dominate the construction management space.

The stock is undervalued relative to its peers, offering a strong growth opportunity.

The recent management shift, while initially causing concern, could streamline operations and improve regional growth.

At its current price of $53–$54, Procore presents a low-risk buying opportunity for long-term investors. If you’d like to discuss my take on Procore further, feel free to reach out. Always happy to chat!